1.Malaysia Payroll Statutory Submission

One a monthly basis or yearly, employers are require to regularly furnish updated information to the authorities.

Some of the reports that a Payroll system can auto generate to ease the job of a HR processor includes the below reports

EPF

Borang A

Govt_EPF_Autopay

SOCSO

Borang 8A_SOCSO

Govt_SOCSO_Autopay

SOCSO Form 2

SOCSO Form 3

EIS

LHDN

Tax CP39

Tax CP39 – Diskette

Tax CP39A

Tax CP39A – Diskette

Income Tax CP22

Income Tax CP22A

Income Tax CP21

Tax CP8A (EA Form)

Tax CP8C (EC Form)

Tax CP8D (Form E)

CP8D_PDF

CP8D_Text

CP159

Govt_TAX_Autopay

Tabung Haji

Tabung Haji (LUTH)

Tabung Haji – Diskette

Zakat

Auto Bank (Salary/EPF/Socso/LHDN)

2.KWSP EPF Malaysia

KWSP EPF Malaysia

Register an EPF Account for a Company

Based on the requirements of the Employees Provident Fund Act 1991, employers are required to register for with the EPF office within seven days from the date that the employer becomes liable to contribute, that is as soon as an employee is hired.

To register with the EPF, an employer would be required to complete Form KWSP 1 with supporting documents including Section 14, Section 15 which will be issued by the Companies Commission or a Business Registration Certificate together with the application for registration.

Once the employer has been registered, the company or employer in question would receive the following:

- An Employer’s Reference Number (this must be used in all EPF dealings);

- Form KWSP 6 (Form A) for the payment of monthly contributions;

- Form KWSP 3 to register employees as member;

- Form KWSP 4 which is a nomination form;

2.1.Wage Subject to EPF

Wage Subject to EPF

Wages

All remuneration in money due to an employee under his contract of service or apprenticeship whether it was agreed to be paid monthly, weekly, daily or otherwise.

Among the payments that are liable for EPF contribution:

- Salary

- Payment for unutilised annual or medical leave

- Bonus

- Allowance

- Commission

- Incentive

- Arrears of wages

- Wages for maternity leave

- Wages for study leave

- Wages for half day leave

- Other payments under services contract or otherwise

View: Section 2: Interpretation

Among the payments not liable for EPF contribution:

- Service charges

- Overtime payment

- Gratuity

- Retirement benefits

- Retrenchment, temporary and lay-off termination benefits

- Any travelling allowance or the value of any travelling concession

- Payment in lieu of notice of termination of employment

- Director’s fee

Refer details explanation on exemptions

2.2.EPF Rates

EPF Rates

Employees aged < 60

Monthly salary of RM 5,000 or less:

- Employee contributes ~ 11% of his monthly salary.

- Employer contributes an amount equivalent to ~13% of the employee’s salary

Monthly salary more than RM 5,000:

- Employee contributes ~ 11% of his monthly salary.

- Employer contributes an amount equivalent to ~12% of the employee’s salary

Employees aged 60 and above, up to 75 years old

Monthly salary of RM 5,000 or less:

- Employee contributes ~ 5.5% of his monthly salary.

- Employer contributes an amount equivalent to 6.5% of the employee’s salary

Monthly salary greater than RM 5,000:

- Employee contributes ~ 5.5% of his monthly salary.

- Employer contributes an amount equivalent to 6% of the employee’s salary

Foreigners

Foreigners who opt to contribute to EPF have the same minimum monthly contributions as Malaysians, but their employers are only required to contribute RM 5 monthly but may opt to contribute more.

Foreigner more than 60 years of age for the months where the wages exceed RM20,000.00, the contribution by the employee shall be calculated at the rate of 5.5% of the amount of wages for the month,

and the total contribution which includes cents shall be rounded to the next ringgit. The rate of contribution by the employer is RM5.00

2.3.EPF Contribution Payment

EPF Contribution Payment

Contribution Month

The contribution month is the month in which contribution is payable based on the salary of the preceding month. Contribution for any given month must be paid on or before the 15th of the month.

For example, in the case of salary for January 2009, the contribution month is February 2009, and contribution must be paid on or before 15th February. (The contribution for any given month is from the salary deduction from the previous month).

Penalty

Interest will be charged for late payment of contribution calculated based on the dividend rate declared by the EPF Board for each respective year with an additional one (1) percent. The minimum interest imposed is RM 10. Any total for the interest with sen must be rounded up to the nearest higher Ringgit.

Example: If the interest imposed is RM 13.21 this must be rounded up to RM 14.

If the contribution is made later than the last day of the following month then there will be a dividend charge in addition to the interest . This dividend charge will be added to the employee’s EPF saving account.

Dividend: The dividend rate imposed is calculated based on the dividend rate declared by the EPF Board for each respective year.

Payment mode to EPF

KWSP is urging all employers to start using its e-Caruman online payments facility as they are slowly moving away from its manual system for EPF contributions by employers with effect from January 2017. All employer transactions with EPF should be done online going forward and instead of the manual submission of Form A. Payment can be made by logging into KWSP iAkaun and submitting all employee contribution details online.

Payment Method By Employer

Contribution payment can be made through:

i. Online banking

• Financial Processing Exchange (FPX)

• Direct Debit Authorization (DDA)

• Bank Portal (M2U)

ii. Internet Banking

iii. Cheques

iv. Bankers Cheques

v. Money Order / Postal Order

vi. Cash

All payments must be made to KUMPULAN WANG SIMPANAN PEKERJA.

2.4.Offences & Penalty EPF

Offences And Penalties EPF

The following are the offences and penalties under the EPF Act 1991 And The EPF Rules And Regulations 1991:

|

Section |

Offences |

Penalties |

|

41(1) |

An employer who fails to register with the Board within 7 days from the date he becomes liable to contribute. |

Shall be liable to a imprisonment term not exceeding 3 years or to a fine not exceeding RM10,000 or both. |

|

41(3) |

An employer who fails to notify the Board within 30 days from the date he ceases liability to contribute. |

Shall be liable to a imprisonment term not exceeding 6 months or to a fine not exceeding RM2,000 or both |

|

42(1) |

An employer who fails to furnish the statement of wages to his employee. |

Shall be liable to a imprisonment term not exceeding 6 months or to a fine not exceeding RM2,000 or both. |

|

43(2) |

Any employer who fails to contribute to the EPF Board on behalf of each of his employee. The contribution shall be remitted on or before the 15th day of the month. |

Shall be liable to a imprisonment term not exceeding 3 years or to a fine not exceeding RM10,000 or both. |

|

47(1) |

Any employer who deducts or attempts to deduct from the wages or remuneration of any employee the whole or any part of the employer’s share of contribution. |

Shall be liable to a imprisonment term not exceeding 6 years or to a fine not exceeding RM20,000 or both. |

|

48(3) |

Any employer who deducts the employee’s share of contributions from the wages of an employee and fails to pay the total sum deducted or any part of the sum to EPF. |

Shall be liable to a imprisonment term not exceeding 6 years or to a fine not exceeding RM20,000 or both. |

|

59(a) |

Any person who makes orally or in writing, or signs any declaration, return, certificate or document which is untrue or incorrect. |

Shall be liable to a imprisonment term not exceeding 3 years or to a fine not exceeding RM10,000 or both. |

3.What is Socso

SOCSO (Social Security Organization), also known as PERKESO (Pertubuhan Keselamatan Sosial), is a Malaysian government agency that was established to provide social security protections to Malaysian employees under the Employees’ Social Security Act, 1969.

A. Employer

Employers are categorised into two, namely principal employer and immediate employer.

Principal Employer

An employer who directly employs an employee under a contract of service or apprenticeship. All matters relating to services and payment of wages are handled by them.

Immediate Employer

An employer who employs an employee by or through him to perform work under the supervision of a principal employer. This includes a person who has a contract of service with an employee and temporarily lends or lease the service of that employee to a principal employer.

Employer’s Responsibility

Principal and immediate employers who employ one or more employees are responsible to register and pay contributions to SOCSO.

The principal employers are also accountable to ensure the registration and payment of contributions for all employees employed by the immediate employer.

The employer is obliged to report all work related accident that befalls their workers within 48 hours of notification.

B. Employee

All eligible Malaysian citizens and permanent residents employees are compulsory to register.

Employee’s Eligibility

All employees who are employed under a contract of service or apprenticeship in the private sector and contractual / temporary staff of Federal / State Government as well as Federal / State Statutory Bodies need to be registered and insured under SOCSO. Contribution will be capped at monthly remuneration of RM4,000.00.

Employees exempted from Employees’ Social Security Act 1969 coverage are as follows:

- Federal and State Government permanent employees

- Domestic servants

- Self-employed

- Sole proprietor or owners of partnership

- Spouse/s of a sole proprietor or partners

- Foreign workers

3.1.Socso Registration

Socso Registration

Register for SOCSO

Both employers and employees are able to register for SOCSO via Form 1 and Form 2. The registration can be done either via SOCSO counters or through the Malaysian Corporate Identity (My CoID).

When registering at the SOCSO counters, the registration can be done by the employer or the employer’s representative. Upon registration, the supporting documents from the relevant agencies must be provided. If an employer were to send a representative in their place for the registration, an authorization letter from the employer is needed.

If the registration is done thought the My CoID method, employers are required to submit their registration forms together with the needed supporting documents to SOCSO. This is on the condition that the eligibility requirements under the Employees’ Social Security Act are met.

For the registration process, employers are required to submit and attach all the needed supporting documents which will be determined by the business entity type. It is the responsibility of the employer to ensure that the necessary details, such as the identification card number for example, is included in Form 2.

Employers Maintain Records

Employers are responsible for maintaining the necessary particulars in respect of each month for each employee in the industry. The details which must be kept in the register include the following:

- Name

- Identification number

- Occupation

- The amount of contribution for the month

- The employee contribution type

- Monthly salary amount

- Allowance (if any)

All employers are required to maintain and keep each register as needed, and this includes all records of payment of contribution make to SOCSO for the past seven years from the date of the last entry therein.

3.2.Wage Subject to Socso

Wage Subject to Socso

Definition Of Wages

-

Any remuneration payable in money to an employee is taken as wages for purposes of SOCSO contributions. This includes the following payments:

i. Salary

ii. Overtime payments

iii. Commission and service charge

iv. Payments for leave; such as annual, sick, maternity, rest day,

public holidays and etc

v. Allowances such as incentives, shift, food / meal, cost of living, housing and etc -

All payments made to an employee paid at an hourly rate, daily rate, weekly rate, piece or task rate is considered as wages. However the following payments are not considered as wages:

i. Payments by an employer to any statutory fund for employees

ii. Mileage claims

iii. Gratuity payments or payments for dismissal or retrenchments

iv. Annual bonus

3.3.Socso Rate Of Contribution

Socso Rate Of Contribution

The contributions depend on an employee’s monthly wage and it is contributed by both the employer and the employee. The amount paid is calculated at 0.5% of the employee’s monthly earnings along with the 1.75% contribution [of the monthly payroll] from the employer. Though self-employed persons, domestic workers and foreigners are exempted from paying SOCSO, they can opt for voluntary coverage.

Two SOCSO categories

Employment Injury and Invalidity Scheme

- All employees younger than 60 years old contribute under this category, unless they began contributing at the age of 55 or above.

- Under this category, every month, the employer contributes a value based on the employee’s monthly salary up to a maximum value of RM 69.05, and the employee contributes up to a maximum value of RM 19.75.

Employment Injury Scheme

- For employees who are 60 years old and above.

- For employees who began contributing to SOCSO at the age of 55 or above.

- For insured people receiving an invalidity pension while still working, and receiving less than one third of their average monthly salary before invalidity.

- Under this category, the employee does not contribute, and every month, the employer contributes a value equivalent to 1.25% of the employee’s monthly salary, up to a maximum value of RM 49.40.

|

RATE OF CONTRIBUTIONS |

|||||

|---|---|---|---|---|---|

|

No. |

Actual monthly wage of the month |

First Category and Invalidity Scheme) |

Second Category Scheme) |

||

|

Employer’s |

Employee’s |

Total Contribution |

Contribution By Employer Only |

||

|

1. |

Wages up to RM30

|

40 cents |

10 cents |

50 cents |

30 cents |

|

2. |

When wages exceed RM30 but not RM50 |

70 cents |

20 cents |

90 cents |

50 cents |

|

3. |

When wages exceed RM50 but not RM70 |

RM1.10 |

30 cents |

RM1.40 |

80 cents |

|

4. |

When wages exceed RM70 but not RM100 |

RM1.50 |

40 cents |

RM1.90 |

RM1.10 |

|

5. |

When wages exceed RM100 but not RM140 |

RM2.10 |

60 cents |

RM2.70 |

RM1.50 |

|

6. |

When wages exceed RM140 but not RM200 |

RM2.95 |

85 cents |

RM3.80 |

RM2.10 |

|

7. |

When wages exceed RM200 but not RM300 |

RM4.35 |

RM1.25 |

RM5.60 |

RM3.10 |

|

8. |

When wages exceed RM300 but not RM400 |

RM6.15 |

RM1.75 |

RM7.90 |

RM4.40 |

|

9. |

When wages exceed RM400 but not RM500 |

RM7.85 |

RM2.25 |

RM10.10 |

RM5.60 |

|

10. |

When wages exceed RM500 but not RM600 |

RM9.65 |

RM2.75 |

RM12.40 |

RM6.90 |

|

11. |

When wages exceed RM600 but not RM700 |

RM11.35 |

RM3.25 |

RM14.60 |

RM8.10 |

|

12. |

When wages exceed RM700 but not RM800 |

RM13.15 |

RM3.75 |

RM16.90 |

RM9.40 |

|

13. |

When wages exceed RM800 but not RM900 |

RM14.85 |

RM4.25 |

RM19.10 |

RM10.60 |

|

14. |

When wages exceed RM900 but not RM1,000 |

RM16.65 |

RM4.75 |

RM21.40 |

RM11.90 |

|

15. |

When wages exceed RM1,000 but not RM1,100 |

RM18.35 |

RM5.25 |

RM23.60 |

RM13.10 |

|

16. |

When wages exceed RM1,100 but not RM1,200 |

RM20.15 |

RM5.75 |

RM25.90 |

RM14.40 |

|

17. |

When wages exceed RM1,200 but not RM1,300 |

RM21.85 |

RM6.25 |

RM28.10 |

RM15.60 |

|

18. |

When wages exceed RM1,300 but not RM1,400 |

RM23.65 |

RM6.75 |

RM30.40 |

RM16.90 |

|

19. |

When wages exceed RM1,400 but not RM1,500 |

RM25.35 |

RM7.25 |

RM32.60 |

RM18.10 |

|

20. |

When wages exceed RM1,500 but not RM1,600 |

RM27.15 |

RM7.75 |

RM34.90 |

RM19.40 |

|

21. |

When wages exceed RM1,600 but not RM1,700 |

RM28.85 |

RM8.25 |

RM37.10 |

RM20.60 |

|

22. |

When wages exceed RM1,700 but not RM1,800 |

RM30.65 |

RM8.75 |

RM39.40 |

RM21.90 |

|

23. |

When wages exceed RM1,800 but not RM1,900 |

RM32.35 |

RM9.25 |

RM41.60 |

RM23.10 |

|

24. |

When wages exceed RM1,900 but not RM2,000 |

RM34.15 |

RM9.75 |

RM43.90 |

RM24.40 |

|

25. |

When wages exceed RM2,000 but not RM2,100 |

RM35.85 |

RM10.25 |

RM46.10 |

RM25.60 |

|

26. |

When wages exceed RM2,100 but not RM2,200 |

RM37.65 |

RM10.75 |

RM48.40 |

RM26.90 |

|

27. |

When wages exceed RM2,200 but not RM2,300 |

RM39.35 |

RM11.25 |

RM50.60 |

RM28.10 |

|

28. |

When wages exceed RM2,300 but not RM2,400 |

RM41.15 |

RM11.75 |

RM52.90 |

RM29.40 |

|

29. |

When wages exceed RM2,400 but not RM2,500 |

RM42.85 |

RM12.25 |

RM55.10 |

RM30.60 |

|

30. |

When wages exceed RM2,500 but not RM2,600 |

RM44.65 |

RM12.75 |

RM57.40 |

RM31.90 |

|

31. |

When wages exceed RM2,600 but not RM2,700 |

RM46.35 |

RM13.25 |

RM59.60 |

RM33.10 |

|

32. |

When wages exceed RM2,700 but not RM2,800 |

RM48.15 |

RM13.75 |

RM61.90 |

RM34.40 |

|

33. |

When wages exceed RM2,800 but not RM2,900 |

RM49.85 |

RM14.25 |

RM64.10 |

RM35.60 |

|

34. |

When wages exceed RM2,900 but not RM3,000 |

RM51.65 |

RM14.75 |

RM66.40 |

RM36.90 |

|

35. |

When wages exceed RM3,000 but not RM3,100 |

RM53.35 |

RM15.25 |

RM68.60 |

RM38.10 |

|

36. |

When wages exceed RM3,100 but not RM3,200 |

RM55.15 |

RM15.75 |

RM70.90 |

RM39.40 |

|

37. |

When wages exceed RM3,200 but not RM3,300 |

RM56.85 |

RM16.25 |

RM73.10 |

RM40.60 |

|

38. |

When wages exceed RM3,300 but not RM3,400 |

RM58.65 |

RM16.75 |

RM75.40 |

RM41.90 |

|

39. |

When wages exceed RM3,400 but not RM3,500 |

RM60.35 |

RM17.25 |

RM77.60 |

RM43.10 |

|

40. |

When wages exceed RM3,500 but not RM3,600 |

RM62.15 |

RM17.75 |

RM79.90 |

RM44.40 |

|

41. |

When wages exceed RM3,600 but not RM3,700 |

RM63.85 |

RM18.25 |

RM82.10 |

RM45.60 |

|

42. |

When wages exceed RM3,700 but not RM3,800 |

RM65.65 |

RM18.75 |

RM84.40 |

RM46.90 |

|

43. |

When wages exceed RM3,800 but not RM3,900 |

RM67.35 |

RM19.25 |

RM86.60 |

RM48.10 |

|

44. |

When wages exceed RM3,900 but not RM4,000 |

RM69.05 |

RM19.75 |

RM88.80 |

RM49.40 |

|

45. |

When wages exceed RM4,000 |

RM69.05 |

RM19.75 |

RM88.80 |

RM49.40 |

- Monthly contribution is subject to the ceiling of the insured wage of RM4,000.00 per month.

Refund of Contributions

Employers who make an error in contribution payments or overpay may claim a refund by submitting claims document to SOCSO office. Please refer to the checklist and ensure that the required documents are completed.

- Checklist

- Erraneous contribution payment schedule (PKSK50A).

- Application contribution refund report.

- Application for refund of contribution (PKSK50).

3.4.PERKESO ASSIST Portal

PERKESO ASSIST Portal

It allows Employees to check their contribution status, and allow Employers to make contributions and payment online.

- Pay Your SOCSO Online

- Make Your Contribution

- Pay Your Contribution

- View Your Contribution

Making Payments to SOCSO

Employers must fulfil their monthly contributions to SOCSO no later than the 15th of following month. There are 2 ways an employer can easily go about making their payments to SOCSO:

- Making payments through the banks – Employers can make payment through the following branches:

- CIMB Bank

- Malayan Bank (Maybank)

- RHB Bank

- Public Bank

- Bank Muamalat

- Pejabat Pos Malaysia (applicable for Sabah & Sarawak only)

- Payment via FPX gateway – Payments can also be made to any of the following branches:

- Maybank

- CIMB Bank

- RHB Bank

- Public Bank

- OCBC Bank

- AmBank

- Bank Islam

- Hong Leong Bank

Interest on Late Payment of Contributions

Interest on late payment of contributions will be imposed at a rate of 6% per annum for each day of contributions not paid within the stipulated period.

The minimum fine is RM 5, hence if the monthly fine is calculated to be less than RM5 it will be charged at RM 5 per month.

3.5.Employment Insurance System

The Employment Insurance System (EIS) is a financial scheme aimed at helping employees who lost their jobs until they find new employment.

The contributions are being collected in a fund in order to provide financial assistance to retrenched employees.

1) Form SIP 1A – Employer’s Notification Form

2) Form SIP 2A – Employee’s Notification Form

3) Form SIP 1 – Employer’s Registration Form

4) Form SIP 2 – Employee’s Registration Form

1. Employer & Employee Contributions

All private sector employers need to pay monthly contributions for each employee. Civil servants, domestic servants and those who are self-employed are exempted. All employees from 18 years of age until 60 years of age have to contribute. Employees aged between 57 and 60 who have never contributed to SOCSO are exempted from this protection plan.

2. Contribution Rates

The contribution rate for EIS is ~0.2% of the employee’s salary (employer share) and ~0.2% of the employee’s salary (employee share). The maximum eligible monthly salary is capped at RM 4,000.

You may refer to the contribution table below for more information:

| Amount of Wages | Employer Contribution |

Employee Contribution | Total Contribution | |

| 1 | Wages up to RM30 | 5 sen | 5 sen | 10 sen |

| 2 | When wages exceed RM30 but not exceed RM50 | 10 sen | 10 sen | 20 sen |

| 3 | When wages exceed RM50 but not exceed RM70 | 15 sen | 15 sen | 30 sen |

| 4 | When wages exceed RM70 but not exceed RM100 | 20 sen | 20 sen | 40 sen |

| 5 | When wages exceed RM100 but not exceed RM140 | 25 sen | 25 sen | 50 sen |

| 6 | When wages exceed RM140 but not exceed RM200 | 35 sen | 35 sen | 70 sen |

| 7 | When wages exceed RM200 but not exceed RM300 | 50 sen | 50 sen | RM1.00 |

| 8 | When wages exceed RM300 but not exceed RM400 | 70 sen | 70 sen | RM1.40 |

| 9 | When wages exceed RM400 but not exceed RM500 | 90 sen | 90 sen | RM1.80 |

| 10 | When wages exceed RM500 but not exceed RM600 | RM1.10 | RM1.10 | RM2.20 |

| 11 | When wages exceed RM600 but not exceed RM700 | RM1.30 | RM1.30 | RM2.60 |

| 12 | When wages exceed RM700 but not exceed RM800 | RM1.50 | RM1.50 | RM3.00 |

| 13 | When wages exceed RM800 but not exceed RM900 | RM1.70 | RM1.70 | RM3.40 |

| 14 | When wages exceed RM900 but not exceed RM1,000 | RM1.90 | RM1.90 | RM3.80 |

| 15 | When wages exceed RM1,000 but not exceed RM1,100 | RM2.10 | RM2.10 | RM4.20 |

| 16 | When wages exceed RM1,100 but not exceed RM1,200 | RM2.30 | RM2.30 | RM4.60 |

| 17 | When wages exceed RM1,200 but not exceed RM1,300 | RM2.50 | RM2.50 | RM5.00 |

| 18 | When wages exceed RM1,300 but not exceed RM1,400 | RM2.70 | RM2.70 | RM5.40 |

| 19 | When wages exceed RM1,400 but not exceed RM1,500 | RM2.90 | RM2.90 | RM5.80 |

| 20 | When wages exceed RM1,500 but not exceed RM1,600 | RM3.10 | RM3.10 | RM6.20 |

| 21 | When wages exceed RM1,600 but not exceed RM1,700 | RM3.30 | RM3.30 | RM6.60 |

| 22 | When wages exceed RM1,700 but not exceed RM1,800 | RM3.50 | RM3.50 | RM7.00 |

| 23 | When wages exceed RM1,800 but not exceed RM1,900 | RM3.70 | RM3.70 | RM7.40 |

| 24 | When wages exceed RM1,900 but not exceed RM2,000 | RM3.90 | RM3.90 | RM7.80 |

| 25 | When wages exceed RM2,000 but not exceed RM2,100 | RM4.10 | RM4.10 | RM8.20 |

| 26 | When wages exceed RM2,100 but not exceed RM2,200 | RM4.30 | RM4.30 | RM8.60 |

| 27 | When wages exceed RM2,200 but not exceed RM2,300 | RM4.50 | RM4.50 | RM9.00 |

| 28 | When wages exceed RM2,300 but not exceed RM2,400 | RM4.70 | RM4.70 | RM9.40 |

| 29 | When wages exceed RM2,400 but not exceed RM2,500 | RM4.90 | RM4.90 | RM9.80 |

| 30 | When wages exceed RM2,500 but not exceed RM2,600 | RM5.10 | RM5.10 | RM10.20 |

| 31 | When wages exceed RM2,600 but not exceed RM2,700 | RM5.30 | RM5.30 | RM10.60 |

| 32 | When wages exceed RM2,700 but not exceed RM2,800 | RM5.50 | RM5.50 | RM11.00 |

| 33 | When wages exceed RM2,800 but not exceed RM2,900 | RM5.70 | RM5.70 | RM11.40 |

| 34 | When wages exceed RM2,900 but not exceed RM3,000 | RM5.90 | RM5.90 | RM11.80 |

| 35 | When wages exceed RM3,000 but not exceed RM3,100 | RM6.10 | RM6.10 | RM12.20 |

| 36 | When wages exceed RM3,100 but not exceed RM3,200 | RM6.30 | RM6.30 | RM12.60 |

| 37 | When wages exceed RM3,200 but not exceed RM3,300 | RM6.50 | RM6.50 | RM13.00 |

| 38 | When wages exceed RM3,300 but not exceed RM3,400 | RM6.70 | RM6.70 | RM13.40 |

| 39 | When wages exceed RM3,400 but not exceed RM3,500 | RM6.90 | RM6.90 | RM13.80 |

| 40 | When wages exceed RM3,500 but not exceed RM3,600 | RM7.10 | RM7.10 | RM14.20 |

| 41 | When wages exceed RM3,600 but not exceed RM3,700 | RM7.30 | RM7.30 | RM14.60 |

| 42 | When wages exceed RM3,700 but not exceed RM3,800 | RM7.50 | RM7.50 | RM15.00 |

| 43 | When wages exceed RM3,800 but not exceed RM3,900 | RM7.70 | RM7.70 | RM15.40 |

| 44 | When wages exceed RM3,900 but not exceed RM4,000 | RM7.90 | RM7.90 | RM15.80 |

| 45 | When wages exceed RM4,000 | RM7.90 | RM7.90 | RM15.80 |

4.Types of Company Forms for Submission

BORANG CP22 – Notification of New Employees to LHDN Borang CP22 [Pin. 1/2011] (Format Ms Word)

BORANG CP22A – Tax Clearance Form for Cessation of Employment of Private Sector Employees Form CP22A [Pin.1/2015]

BORANG CP22B – Tax Clearance Form for Cessation of Employment of Public Sector Employees Form CP22B [Pin.1/2015]

FORM CP21 – Notification by Employer of Departure from the Country of an Employee Form CP21 [Pin. 1/2015]

FORM EA – Statement of Remuneration from Employment – Private Sector Form C.P.8A (EA) ; Guide Notes for Forms EA & EC ; Notes for Part F of Form EA

FORM EC – Statement of Remuneration from Employment – Public Sector Form C.P.8C (EC) ; Guide Notes for Forms EA & EC

FORM STD 2(II) – Employer’s Statement on Payment of Tax Form PCB 2(II) (Pin.2012)

FORM CP39 (Normal MTD) – Statement of Monthly Tax Deduction (MTD) [Normal Remuneration] Form CP39

FORM CP 39A (MTD for Arrears) – Statement of Monthly Tax Deduction (MTD) [Additional Remuneration] Form CP 39A

FORM PCB/TP 1 – Monthly Tax Deduction (MTD) – Form regarding Claim of Deduction and Rebate by Individual Form PCB/TP1

FORM PCB/TP 3 – Form of Information Related to Employment with Previous Employer Form PCB/TP3

4.1.Employer's Responsiblities

Employer’s responsibilities under the MTD Rules are as follows:

- Deduct the MTD from the remuneration of employee in each month or the relevant month in accordance with the Schedule of Monthly Tax Deductions or Computerised Calculation Method and pay to the Director General.

- Make additional deductions from employee’s remuneration in accordance with the direction given by the Director General under Rule 4 of MTD Rules.

- Employer shall pay to the Director General, not later than the fifteen day of every calendar month, the total amount of tax deducted or should have been deducted by him from the remuneration of employees during the preceding calendar month.

- Furnish a complete and accurate employees’ information of the following in a return when submitting MTD payments/additional deductions:

- income tax number (if any);

- name as stated on identity card or passport;

- new and old identity card number/police number/army number or passport number (for foreign employee); and

- MTD/additional deductions amount.

4.2.Who Needs To Register Tax File

For a business or company which has employees shall register employer tax file.

In order to be taxable, you would have to earn about RM36,480 per year after EPF deductions (about RM3,040 per month), inclusive of all benefits, allowances, bonuses, overtime, and commissions

If you’re earning anywhere below that figure, then there’s no need for you to open up a file for tax to be deducted from your income.

However, if you do earn above that, you need to have a tax file opened with your income tax automatically deducted from your income.

Minimum for Tax deduction

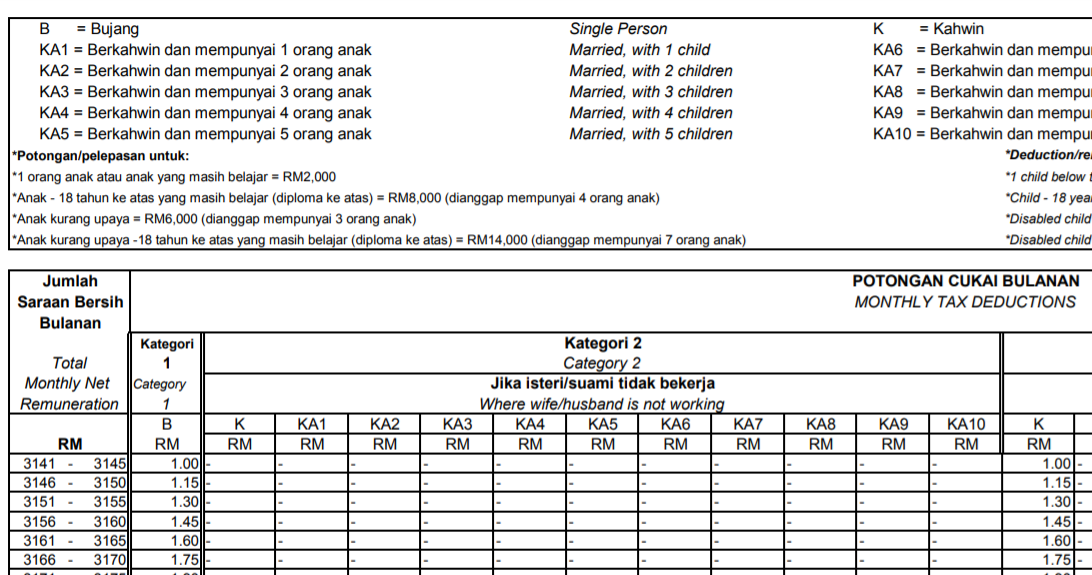

Monthly Tax Deduction Table 2018 (MTD)

4.3.Types of Remuneration Subject to MTD

Types of Remuneration Subject to MTD

Remuneration means income in respect of the gains or profits from an employment except benefits in kind (BIK), VOLA & Zakat

–Normal remuneration– means monthly fixed remuneration paid to an employee whether the amount is fixed or variable as stated in the employment contract written or otherwise.

–Additional remuneration– means any payment paid to an employee either in one lump sum or periodical or in arrears or non fixed payment or any additional payment to a current month`s normal remuneration

- overtime allowance

- bonus/incentive

- arrears of salary or any other arrears paid to an employee

- employee`s share option scheme (if employee opts for MTD deduction)

- tax borne by employer

- gratuity

- compensation for loss of employment

- ex-gratia

- director`s fee (not paid monthly)

- commissions

- allowances (variable amount either paid every month or not )

- any other payment in addition to normal remuneration for current month

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.4.Remuneration Not Subject to MTD

Remuneration Not Subject to MTD

BIK and VOLA are part of remuneration which is not subject to MTD. However, employee may make an irrevocable election to include the BIK and VOLA as part of his remuneration to be subject to MTD by completing a prescribed form and submit to employer. If employer agrees, BIK and VOLA are subjected to MTD.

- Benefits in Kind (BIK)

- Value of Living Accommodation (VOLA)

- Deduction for Zakat

4.5.MTD Schedule Step 1

Additional Remuneration MTD computation based on Schedule of Monthly Tax Deductions

MTD Computation Step 1

Step 1 – Determine MTD on net normal remuneration for a year (not including current month additional remuneration) and MTD for additional remuneration which has been paid.

[A] Determine category of employee.

[B] Determine net normal remuneration = Gross normal remuneration less (-) EPF or any other Approved Scheme (limited to RM500.00 per month or RM6,000.00 per year).

[C] Determine current month MTD for net normal remuneration in Step 1 [B].

MTD for current month = RMXXX [refer to Schedule of Monthly Tax Deductions]

Net MTD = MTD for current month – zakat and fee/levy for current month

[D] Total MTD for a year = Total paid accumulated MTD + [MTD for current month at Step [C] x remaining month in a year include current month]

= X + [MTD for current month at Step [C] x (n + 1)]

4.6.MTD Schedule Step 2

MTD computation Step 2

Step 2 – Determine chargeable income for a year [P] (including additional remuneration for current month) and MTD for additional remuneration which has been paid.

[A] Determine category of employee.

[B] Determine chargeable income for a year [P];

P = [( Y – K ) x 12] + [S(Yt1 – Kt1)] + (Yt – Kt) – ( D + S + 1000C)

4.7.MTD Schedule Step 3

MTD Computation Step 3

Step 3 – Determine total tax for a year based on value of P in Step 2 [B]. Value of M, R and B are based on value as per Schedule 1 below.

Total tax for a year = (P – M) x R + B

| Schedule 1: Value of P, M, R and B | ||||

|---|---|---|---|---|

|

P (RM) |

M (RM) |

R (%) |

B Category 1 & 3 (RM) |

B Category 2 (RM) |

| 2,500 – 5,000 | 2,500 | 1 | – 400 | – 800 |

| 5,001 – 20,000 | 5,000 | 3 | – 375 | – 775 |

| 20,001 – 35,000 | 20,000 | 7 | 75 | – 325 |

| 35,001 – 50,000 | 35,000 | 12 | 1,525 | 1,525 |

| 50,001 – 70,000 | 50,000 | 19 | 3,325 | 3,325 |

| 70,001 – 100,000 | 70,000 | 24 | 7,125 | 7,125 |

| Above 100,000 | 100,000 | 26 | 14,325 | 14,325 |

4.8.MTD Schedule Step 4

MTD Computation Step 4

Step 4 – Determine MTD for current month additional remuneration where total tax (Step 3) less total MTD for a year (Step 1[D]) and zakat which has been paid.

MTD for additional remuneration = Step 3 – [Step 1[D]+ zakat which has been paid]

Deduction for Zakat Schedule of MTD

Where an employee has made zakat payments through salary to the religious authority, the employer upon receiving evidence of such payments may set-off those payments against the amount of tax to be deducted for the respective month.

Example 1: MTD for January 2010

|

RM |

||

|

MTD deductible according to schedule |

105.00 |

|

|

Zakat paid |

55.00 |

|

|

MTD to be deducted |

50.00 |

(105.00 – 55.00) |

Example 2: MTD for February 2010

|

RM |

||

|

MTD deductible according to schedule |

110.00 |

|

|

Zakat paid |

140.00 |

|

|

MTD to be deducted |

Nil |

(110.00 – 140.00) |

The excess zakat of RM30 in Example 2 above may be carried forward to be off-set against the MTD of a subsequent month. However, please note that such adjustments are permissible only within the same year. That means, zakat paid in year 2010 can be deducted only with MTD to be deducted in year 2010 (current year).

If an employee makes tithes (zakat) payment other than the monthly zakat deduction, the employee may only re-adjust their MTD by using the Computerised Calculation Method by submitting the TP1 Form to their employer, subject to the employers approval.

4.9.MTD Schedule Step 5

MTD Computation Step 5

Step 5 – MTD for current month which shall be paid.

= Net MTD + MTD for current month on additional remuneration = Step 1[C] + Step 4

4.10.MTD Computerised Step 1

MTD Computerised Formula Step 1

Step 1 – Determine MTD on net remuneration for a year (not including current month-s additional remuneration).

A] Determine category of employee.

[B] Determine chargeable income for a year [P];

P = [S(Y- K*)+(Y1 – K1*)+[(Y2 – K2*) x n]+(Yt – Kt*)] – [D+S+1000C + (SLP + LP1)] where (Yt – Kt ) = 0

P Total chargeable income for a year;

∑(Y – K) Total accumulated net normal remuneration and net additional remuneration for the current year, paid to an employee prior to the current month, including net normal remuneration and net additional remuneration paid by previous employer, if any;

Y Total accumulated gross normal remuneration and gross additional remuneration for the current year, paid to an employee prior to the current month, including gross normal remuneration and gross additional remuneration paid by previous employer, if any;

K Total contribution to Employees Provident Fund or other approved scheme paid in respect of Y and life insurance premium paid in the current year, including life insurance premium claimed under previous employment, if any,

subject to the total qualifying amount per year;

Y1 Gross normal remuneration for the current month;

K1 Contribution to Employees Provident Fund or other approved scheme paid in respect of Y1 and life insurance premium paid in the current month, subject to

the total qualifying amount per year;

Y2 Estimated remuneration as Y1 for the subsequent months;

K2 Estimated balance of total contribution to Employees Provident Fund or other approved scheme and life insurance premium paid for the balance of qualifying months [[Total qualifying amount per year – (K + K1 + Kt)] / n] or K1, whichever is lower;

Yt – Kt Net additional remuneration for the current month;

Yt Gross additional remuneration for the current month;

Kt Contribution to Employees Provident Fund or other approved scheme paid in respect of Yt, subject to the total qualifying amount per year;

* K + K1 + K2 + Kt not exceeding the total qualifying amount per year;

**∑(Yt – Kt) only applies to calculation of Monthly Tax Deduction for additional remuneration;

N Balance of month in a year;

n + 1 Balance of month in a year, including current month;

D Deduction for individual;

S Deduction for husband or wife;

DU Deduction for disabled person;

SU Deduction for disabled husband or wife;

Q Deduction for qualifying children;

C Number of qualifying children;Value of D, S and C are determined as follows:

(i) Category 1 = Single:

Value of D = Deduction for individual, S = 0 and C = 0;(ii) Category 2 = Married and husband or wife is not working:

Value of D = Deduction for individual,

Value of S = Deduction for husband or wife, and

Value of C = Number of qualifying children;(iii) Category 3 = Married and husband or wife is working, divorced or widowed, or single

with adopted child:

Value of D = Deduction for individual,

Value of S = 0, and

Value of C = Number of qualifying children;∑LP Accumulated allowable deductions in the current year, including from previous employment, if any;

LP1 Allowable deductions for the current month;

M Amount of the first chargeable income for every range of chargeable income a year;

R Percentage of tax rates;

B Amount of tax on M after deduction of tax rebate for individual and husband or wife, if qualified;

Z Accumulated zakat paid in the current year other than zakat for the current month;

X Accumulated Monthly Tax Deduction paid for the previous month in the current year, including payment from previous employment, but shall not include additional Monthly Tax Deduction requested by the employee and payment of tax installment.[C] Determine monthly MTD for net normal remuneration. Once value of P in Step [B] is determined, value of M, R and B are determined based on Schedule 1 below.

Schedule 1: Value of P, M, R and B P (RM)

M

(RM)

R

(%)

B

Category 1 & 3 (RM)

B

Category 2 (RM)

2,500 – 5,000 2,500 1 – 400 – 800 5,001 – 20,000 5,000 3 – 375 – 775 20,001 – 35,000 20,000 7 75 – 325 35,001 – 50,000 35,000 12 1,525 1,525 50,001 – 70,000 50,000 19 3,325 3,325 70,001 – 100,000 70,000 24 7,125 7,125 Above 100,000 100,000 26 14,325 14,325

MTD for current month = [ (P – M) x R + B ] – (Z+ X ) n + 1

Net MTD = MTD for current month – zakat and fee/levy for current month.

[D] Determine total MTD for a year

Total MTD for a year = Total paid accumulated MTD + [MTD for current month at Step [C] x remaining month in a year include current month]

= X + [(MTD for current month at Step [C] x (n + 1)]

4.11.MTD Computerised Step 2

MTD Computerised Formula Step 2

Step 2 – Determine chargeable income for a year [P] (including additional remuneration for current month) and additional remuneration which has been paid.

[A] Determine category of employee.

[B] Determine chargeable income for a year [P];

P = [S(Y-K*)+ (Y1 – K1*)+[(Y2 – K2*) x n]+(Yt – Kt*)] – [D+S+1000C + (SLP + LP1)]

4.12.MTD Computerised Step 3,4&5

MTD Computerised Formula Step 3, 4 & 5

Step 3 – Determine total tax for a year based on value of P in Step 2 [B]. Value of M, R and B are based on value as per Schedule 1 above.

Total tax for a year = (P – M) x R + B

Step 4 – Determine MTD for current month additional remuneration where total tax (Step 3) less total MTD for a year (Step 1[D]), zakat and fee/levy which have been paid.

MTD for additional remuneration = Step 3 – [Step 1[D] + zakat and fee/levy which has been paid]

Step 5 – MTD for current month which shall be paid.

= Net MTD + MTD for current month on additional remuneration

= Step 1[C] + Step 4

4.13.MTD bonus and director`s fee

MTD bonus and director`s fee

COMPUTERISED CALCULATION FOR ADDITIONAL REMUNERATION

“additional remuneration” means any additional payment to the normal remuneration for the

current month paid to an employee whether in one lump sum, periodical, in arrears or non-fixed

payment.

Such additional remuneration includes:

i. bonus/incentive

ii. arrears of salary or any other arrears paid to an employee

iii. employee’s share option scheme (if employee opts for MTD deduction)

iv. tax borne by employer

v. gratuity

vi. compensation for loss of employment

vii. ex-gratia

viii. director’s fee (not paid monthly)

ix. commissions (not paid monthly)

x. allowances (not paid monthly)

xi. any other payment in addition to normal remuneration for current month

Scenario 1:

Additional remuneration for 2008 to be paid in year 2009.

- Use STD Schedule (Amendment 2004).

- Remuneration in December 2007 will be taken as a basis for computation of STD for Step [A] Bonus Formula.

- Use a separate form when making MTD payment for current month remuneration and additional remuneration.

- Form CP39A for additional remuneration MTD.

- Form CP39 (Pin. 2/05) for current month STD.

Scenario 2:

Additional remuneration for arrears commissions 2009 to be paid in year 2010.

- Use formula computerised calculation method MTD 2009/ Kalkulator PCB 2009.

- Select MTD computation for 2009.

- Select previously employed in current year.

- Click Month of December.

- Input total of accumulated remuneration/MTD/Rebate/Deduction until before current month for current year (including from previous employer) paid from January until December 2009.

- Please leave the current month remuneration as nil and input arrears commissions as current month remuneration including EPF (if any), click calculate.

- Please use Form CP39A for MTD additional remuneratin payment of arrears commissions.

4.14.Penalty for PCB

Penalty for PCB

An employer who fails to remit payment on or before the 15th of the following month (if the 15th is a holiday the deadline will be the last working day before the 15th) can be fined and/or imprisoned .

The fine is a minimum of RM 200 and not more than RM 2,000 or 6 months imprisonment or both. An employer who does not deduct MTD or deducts but fails to remit the MTD to IRBM can be prosecuted in a civil court. With this, the MTD not deducted becomes a debt to the Government.

Furthermore, a late payment penalty of 10% will be imposed on the balance of tax not paid after 30th April following the year of assessment. If the tax and penalty imposed is not paid within 60 days from the date the penalty is imposed, a further penalty of 5% will be imposed on the amount still owing.

5.HRDF Human Resource Development Funds

HRDF Human Resource Development Funds

HRDF Levy

HRDF levy is a mandatory levy payment collected by the Human Resources Development Fund ( PSMB) imposed on employers from certain industries. The purpose is to enable employee training and skills upgrading of the Malaysian workforce.

Employers are liable to register with HRDF

Employers are required to register with PSMB as per the PSMB Act 2001, Section 13(1). Any employer who is not registered with PSMB could be fined up to RM 10,000.00, face up-to a year imprisonment or both (Section 13 (2)).

Firms with 10 or more local workers are obliged to register with PSMB, while firms with 10 or less local works have the option to register.

The Amendment of the First Schedule came into effect 1 April 2017, in summary it states:

| Amendment | Imposed rate of HRDF Levy |

| To standardise the minimum number of local employees to register with PSMB to ten (10) for all employers under the existing coverage and to delete the requirement for paid up capital for the Manufacturing, Mining and Quarrying sectors. | 1 % of the monthly wages of each of their Malaysian employees |

| To allow for voluntary registration to all employers under the existing 63 sub-sectors that employ five (5) to nine (9) local employees | 0.5 % of the monthly wages of each of their Malaysian employees |

What are the HRDF contribution rates?

Payment of HRDF levy is based on the eligibility of employers (referring to the number of local workers). Contribution rates are:

- Employers that have below 10 local workers pay a levy of 0.5%.

- Employers that have 10 and above local workers pay a levy of 1%.

How is HRDF calculated?

HRDF levy = HRDF Levy% x (Basic Salary + Fixed Allowances).

5.1.HRDF Liable Employer

HRDF Liable Employer

REGISTRATION OF LIABLE EMPLOYER

Section 13(1) of the PSMB Act 2001 stipulates that every employer who is covered under the Act is required to register with PSMB within such time and manner as may be prescribed.

Any employer who is convicted for not registering with PSMB may be fined up to an amount not exceeding RM10,000 or face imprisonment up to a year, or both (Section 13 (2)).

According to the First Schedule of PSMB Act, 2001, definitions of industries covered are as follows:

| SUB-SECTOR / INDUSTRY | ELIGIBILITY CRITERIA | RATE OF LEVY PAYMENT |

|---|---|---|

| SERVICES SECTOR | ||

|

≥ 10 Malaysian Employees (mandatory to register) 5 – 9 Malaysian Employees (given option to register) |

1% 0.5% |

| MANUFACTURING SECTOR | ||

| Making or processing of an article by labour or machine or both, including the transformation of parts or components into another article of a different nature or character by way of altering, blending, ornamenting, finishing or otherwise treating or adapting any article or substance with a view to its use, sale, transport, delivery or disposal, including the building of a ship or the assembly of parts of a ship. | ≥ 10 Malaysian Employees (mandatory to register) 5 – 9 Malaysian Employees (given option to register) |

1% 0.5% |

| MINING & QUARRYING SECTOR | ||

|

≥ 10 Malaysian Employees (mandatory to register) 5 – 9 Malaysian Employees (given option to register) |

1% 0.5% |

- Amendment & Expansion Of PSMB Act 2001 kindly download the following Handbook:

5.2.Contribution Payment

When to make HRDF Levy payments

Payments for HRDF levy must be made through HRDF collection agents which are:

- Public Bank Berhad (PBB)

- RHB Bank Berhad

Payments have to made via ESLIP which can be downloaded and printed via ETRIS. Only one (1) cheque transaction is allowed for each ESLIP. However, you can opt to pay arrears for multiple months using a single ESLIP with one (1) accumulated payment cheque.

ETRIS – ELECTRONIC TRANSFORMED INFORMATION SYSTEM INFO

The following modes of payment are acceptable:

- Cash

- Local cheques

- Banker’s order

- Cashier’s cheques

- Money order

- Postal order

Payments will be updated within three (3) working days after the payments are made. You can check the levy payment status via the Levy Statement in the ETRIS.

In the event that the payment is yet to be reflected in the Levy Statement, kindly inform HRDF together with a copy of the ESLIP for checking purposes.

When to pay HRDF levy

An employer who fails to remit payment on or before the 15th of the following month (if the 15th is a holiday, the deadline will be the last working day before the 15th) can be fined and/or imprisoned.

The fine is not more than RM20,000 or up to 2 years imprisonment or both. A late payment penalty of 10% will be imposed on the amount still owing.

6.Employment Act 1955

Employment Act 1955

The Employment Act provides minimum terms and conditions (mostly of monetary value) to certain category of workers.

(a) Any employee as long as his month wages is less than RM2000.00 and

(b) Any employee employed in manual work including artisan, apprentice, transport operator, supervisors or overseers of manual workers, persons employed on vessels and even domestic servants are classified as employees even if their wages is more than RM2000.00 per month.

Contract Of Service

“contract of service” means any agreement, whether oral or in writing and whether express or implied, whereby one person agrees to employ another as an employee and that the other agrees to serve his employer as his employee and includes an apprenticeship contract

Contract of service shall not contain any condition that restricts rights of employees to join, participate in or organize trade unions.

A contract of service must contain a provision for its termination. In the absence of any agreement to the contrary, period of notice for termination of contracts shall be as follows:

(a) 4 weeks’ notice if the employee employed for less than 2 years;

(b) 6 weeks’ notice if so employed for over 2 years but less than 5 years;

(c) 8 weeks’ notice if so employed for 5 years or more.

A contract of service may be terminated for special reasons as such misconduct on the part of the employee. The employer after due inquiry may take the following types of action:

(a) dismiss without notice the employee; or

(b) downgrade the employee; or

(c) impose any other lesser punishment as he deems just and fit, or suspend the employee without wages for a period not more than two weeks.

When contract is deemed to be broken by employer if he fails to pay wages on or before the 7th day.

An employee shall be deemed to have broken his contract of service with the employer if he has been continuously absent from work for more than two consecutive working days without prior leave from his employer, unless he has a reasonable excuse for such absence and has informed or attempted to inform his employer of such excuse prior to or at the earliest opportunity during such absence.

6.1.Working hours, Rest Day, OT

Working hours, Rest Day, OT

Normal Working Hour

an employee shall not be required under his contract of service to work:

(a) more than five consecutive hours without a period of leisure of not less than thirty minutes duration;

(b) more than eight hours in one day;

(c ) in excess of a spread over period of ten hours in one day;

(d) more than forty-eight hours in one week

However, an employee may be required by his employer to exceed the limit of hours above and to work on a rest day, in the case of:

(a) accident, actual or threatened, in his place of work;

(b) work, the performance of which is essential to the life of the community;

(c) work essential for the defence or security of Malaysia;

(d) urgent work to be done to machinery or plant;

(e) an interruption of work which it was impossible to foresee; or

(f) work to be performed by employees in any industrial undertaking essential to the economy of Malaysia or any essential service as defined under the Industrial Relations Act.

Overtime OT

For any overtime work carried out in excess of the normal hours of work, the employee shall be paid at a rate not less than one and half times his hourly rate of pay

No employer shall require or permit an employee to work overtime exceeding such limit as may be prescribed by the Minister from time to time by regulations made under this Act,

Overtime on normal work days

Overtime on rest days

Overtime on public holidays

For any overtime work carried out by an employee on a paid public holiday after normal working hour, the employee shall be paid at a rate which is not less than 3 times his hourly rate of pay.

Overtime (Public Holiday-day) x 3.0

6.2.Leave Entitlement

Employment Act Leave Entitlement

Public Holidays

Every employee shall be entitled to paid holiday at his ordinary rate of pay on the following days in any one calendar year:

(a) on ten of the gazetted public holidays, four of which shall be-

(i) the National Day;

(ii) the Birthday of the Yang di-Pertuan Agong;

(iii) the Birthday of the Ruler or the Yang di-Pertua Negeri of the State or the Federal Territory Day; and

(iv) the Workers’ Day; and

(b) on any day declared as a public holiday under section 8 of the Holidays Act 1951;

If a public holidays falls on a rest day the working day following immediately the rest day shall be a paid holiday in substitution.

Any employee who absents himself from work on the working day immediately preceding or immediately succeeding a public holiday shall not be entitled to any holiday pay for such holiday.

| Paid annual leave for employees: | ||

| Less than two years of service | : | 8 days |

| Two or more but less than five years of service | : | 12 days |

| Over five years of service | : | 16 days |

*Minimum paid annual leave to be provided for employees

| Paid sick leave per calendar year: | ||

| Less than two years of service | : | 14 days |

| Two or more but less than five years of service | : | 18 days |

| Over five years of service | : | 22 days |

| Where hospitalisation is necessary | : | Up to 60 days (inclusive of the paid sick leave entitlement stated above) |

*Minimum paid sick leave to be provided for employees

| Paid maternity leave | : | 60 days |

| Normal work hours | : | Not exceeding eight hours in one day or 48 hours in one week |

| Paid holiday | : | At least 11 gazetted public holidays ( inclusive of five compulsory public holidays; National Day, Birthday of the Yang Dipertuan Agong, Birthday of Ruler/Federal Territory Day, Labour Day and Malaysia day) in one calendar year and on any day declared as a public holiday under section 8 of the Holiday Act 1951 |

6.3.Employees on Probation

Employees on Probation

The Employment Act does distinguish between a employee under probation and other employees. He enjoys all the same rights as any other confirmed employee.

Why probation?

A new employee will invariably have to go through a period of probation enabling the employer to test his or hers suitability of the job he or she is engaged to do. Qualification and skill alone may not make one a good employee, other factors such as aptitude and attitude towards work and fellow workers must also be tested before he or she can be confirmed to take on the job.

The probationer was found to be lacking in certain areas, can he or she then to terminated on or before the end of the probationary period?

It is quite common to find a clause in the contract of service like “..during the probationary period, either party may at any time terminate the contract of service without notice….” and many employers simply make use of the clause to terminate the service of a probationers whom they find to be not to their liking. Employers must be careful about doing this. When a new employee first came to the company, he or she must be given training in the job he or she is supposed to do. After due training the employee still could not do the job properly, he or she must be warned, at first verbally and then in writing or extension of the probationary period if things persist. If there is no improvement despite all that, then he or she is told to go when the probationary period expires. Even in a case of serious misconduct, an employer may not dismiss the employee summarily without first enquiring into the matter.

In Khaliah binti Abbas vs Pesaka Capital Corporation Sdn Bhd, the Court of Appeal ruled that an employee on probation enjoys the same rights as a permanent or confirmed employee and he or she cannot be terminated without just cause or excuse.

If a probationer feels that he or she is terminated without just cause or excuse, he can seek redress under Section 20 of the Industrial Relations Act 1967 for wrongful dismissal.

A probationer who receives no confirmation after the end of the probationary period, is he or she considered confirmed or not confirmed?

In Consolidated Plantation Berhad vs All Malayan Estates Staff Union, the Federal Court held that if an employee continues employment after probationary period, he is still an probationer. In this case an Indian Supreme Court case was cited and in that case, it was held “There can …. no doubt about the position in law that an employee appointed on probation for six months continues as a probationer even after the period of six months if at the end of the period his services had neither been terminated nor confirmed.”

However, if an probationer who receives no confirmation after the probationary period but is given a salary increment, he or she definitely has a strong case that the employer is satisfied with his or her performance.

Again, the position will be different if there is a clause in the contract of service stating that when no confirmation is received after the probationary period, the employee is deemed to be confirmed.

6.4.Termination and Lay-off Benefits

Termination and Lay-off Benefits

In an employee whose contract of service is terminated or he is laid off by his employer he is entitled to the payment by employers of:

(a) termination benefits;

(b) lay-off benefits;

However an employee shall not be entitled to termination benefits payment under the following circumstances –

(a) upon the employee attaining the age of retirement if the contract of service contains a stipulation in that behalf; or

(b) dismissed by the employer, on the grounds of misconduct, or

(c) resigns voluntarily by the employee.

Furthermore an employee shall not be entitled to any termination benefits payment if –

(a) his contract of service is renewed, or he is re-engaged by the same employer under a new contract of service on terms and conditions which are not less favourable; and

(b) the renewal or re-engagement takes effect immediately on the ending of his employment under the previous contract.

An employee is deemed to be laid-off if –

(a) the employer does not provide such work for him on at least a total of twelve normal working days within any period of four consecutive weeks; and

(b) the employee is not entitled to any remuneration under the contract for the period or periods (within such period of four consecutive weeks) in which he is not provided with work;

Termination and lay-off benefits payment shall not be less than –

(a) 10 days’ wages for every year of employment under a continuous contract of service with the employer if he has been employed by that employer for a period of less than 2 years; or

(b) 15 days’ wages for every year of employment under a continuous contract of serviced with the employer if he has been employed by that employer for 2 years or more but less than 5 years; or

(c) 20 days’ wages for every year of employment under a continuous contract of service with the employer if he has been employed by that employer for 5 year or more, and pro-rata as respect an incomplete year, calculated to the nearest month.

Any termination or lay-off benefits payment payable shall be paid by the employer to the employee not later than seven days after the relevant date.